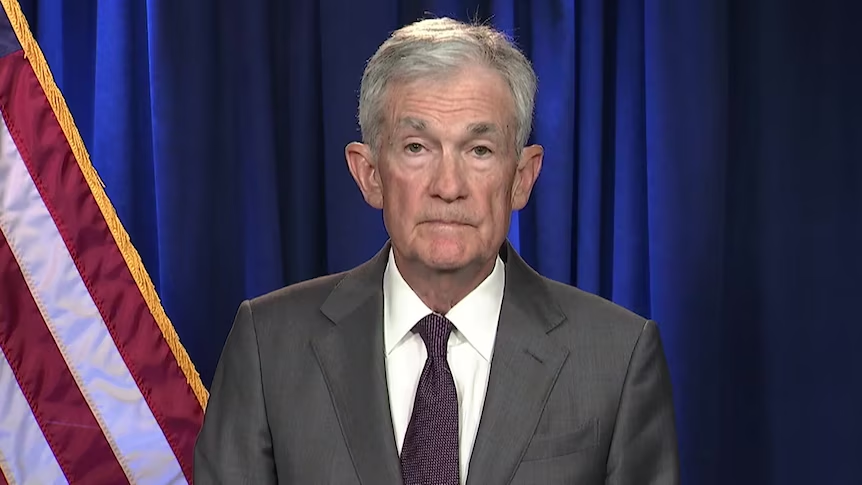

A rare and consequential development has placed the United States Federal Reserve under intense global scrutiny, following the launch of an official investigation involving Federal Reserve Chair Jerome Powell. The episode has ignited debate across political, financial, and economic circles, raising critical questions about central bank independence, market stability, and the future direction of US monetary policy.

While investigations involving top central bank officials are exceedingly uncommon, the current scrutiny of Powell has elevated concerns far beyond Washington. Given the Federal Reserve’s outsized influence on global interest rates, capital flows, and currency markets, any perceived threat to its autonomy carries worldwide implications.

What Is the Investigation About?

The investigation focuses on statements made by Jerome Powell to US lawmakers regarding the scope, oversight, and cost escalation of a major renovation project involving Federal Reserve facilities. The cost of the project reportedly rose significantly over time, prompting questions from political leaders and watchdog bodies.

Authorities are examining whether Powell’s testimony fully and accurately represented the details of the project. At this stage, no charges have been filed, and Powell has not been accused of wrongdoing. However, the mere existence of an investigation into the sitting Fed Chair is unprecedented in modern US economic history.

A senior legal analyst observed, “This is not just about a construction project. It has become a test of how insulated monetary authorities are from political and legal pressure.”

Why Central Bank Independence Is at the Core

The Federal Reserve’s credibility rests heavily on its ability to operate independently of political influence. The institution sets interest rates, manages inflation, and safeguards financial stability based on economic data rather than electoral considerations.

Powell has consistently defended this principle, arguing that monetary policy must be driven by long-term economic health. “The Fed’s responsibility is to the American public, not to political cycles,” he has stated on multiple occasions.

Economists warn that if political pressure is seen as influencing the Fed, markets may begin to price in higher risk premiums, leading to higher borrowing costs, weaker currencies, and volatile asset prices.

Political Tensions and the Broader Context

The investigation comes against the backdrop of long-running political tensions between Powell and sections of the US political leadership. Powell has previously faced criticism for maintaining higher interest rates during inflationary periods, despite political demands for aggressive rate cuts to stimulate growth.

Some analysts argue that the investigation, while legally grounded, is unfolding within a politically charged environment. A former central banker remarked, “Even the perception that monetary policy could be influenced by investigations or threats can be destabilising.”

This has triggered debate over whether legal scrutiny — justified or not — risks undermining confidence in the institution responsible for steering the world’s largest economy.

Market Reactions and Economic Impact

Financial markets responded swiftly to news of the investigation. Investors showed increased caution, with short-term volatility seen across equities, currencies, and bond yields. Safe-haven assets gained attention as uncertainty around future monetary decisions grew.

Market strategists note that prolonged uncertainty could affect:

- Interest rate expectations

- Inflation forecasts

- Strength of the US dollar

- Capital flows to emerging markets

One investment strategist said, “If markets believe the Fed’s leadership is under pressure, it complicates forward guidance and increases volatility.”

Global Concerns and International Reactions

Because the Federal Reserve’s policies influence global liquidity, central bankers and financial leaders worldwide are closely monitoring developments. Many have expressed concern that weakening the Fed’s independence could set a troubling precedent for central banks globally.

An international policy expert explained, “The Fed sets the tone for global monetary governance. If its autonomy is questioned, it could embolden political interference elsewhere.”

Emerging economies are particularly sensitive to shifts in US monetary policy credibility, as sudden changes in rates or capital flows can destabilise currencies and financial systems.

What Lies Ahead for Powell and the Fed

Jerome Powell’s term as Fed Chair is set to conclude in 2026, adding another layer of complexity to the situation. The investigation raises questions about leadership continuity, succession planning, and the timing of major policy decisions.

Powell has reiterated his commitment to transparency and data-driven policymaking. “We will continue to do our job — making decisions based on evidence, analysis, and our mandate,” he said in a recent statement.

Why This Episode Is a Defining Moment

Beyond the legal specifics, the investigation represents a stress test for institutional independence in democratic governance. The outcome could influence how central banks operate, how markets perceive policy credibility, and how future leaders navigate the delicate balance between accountability and autonomy.

As one senior economist summed it up, “This is about more than Jerome Powell. It’s about whether economic institutions can remain insulated from political turbulence in an increasingly polarised world.”

The coming months will be critical in determining not only the fate of the Fed Chair, but also the long-term stability of global monetary governance.