Johns Hopkins Medicine has secured the top position in the 2026 Brand Strength Index for the second consecutive year, leading a global field of elite academic medical centers.

The 2026 Global Top 250 Hospitals report, released by Brand Finance, highlights a period of intense global competition among academic medical centers. As healthcare systems navigate an increasingly complex economic landscape, brand strength has emerged as a critical driver of institutional success. The rankings are derived from a comprehensive survey of 2,500 healthcare professionals and an analysis of more than 30 performance metrics across 500 institutions. This data underscores that a hospital’s reputation is no longer merely a byproduct of clinical success but a strategic asset utilized to secure research funding, attract international talent, and earn patient trust on a global scale.

Johns Hopkins Medicine maintains its status as the world’s most reputable hospital brand, achieving a Brand Strength Index score that reflects its sustained excellence in clinical outcomes and visibility. Following closely are Oxford University Hospitals NHS Foundation Trust in the United Kingdom and Stanford University Medical Center in the United States. These institutions have demonstrated an ability to pair high-impact medical specialties with robust educational and research outputs, maintaining a “brand halo” that influences peer recommendations and patient referrals across borders.

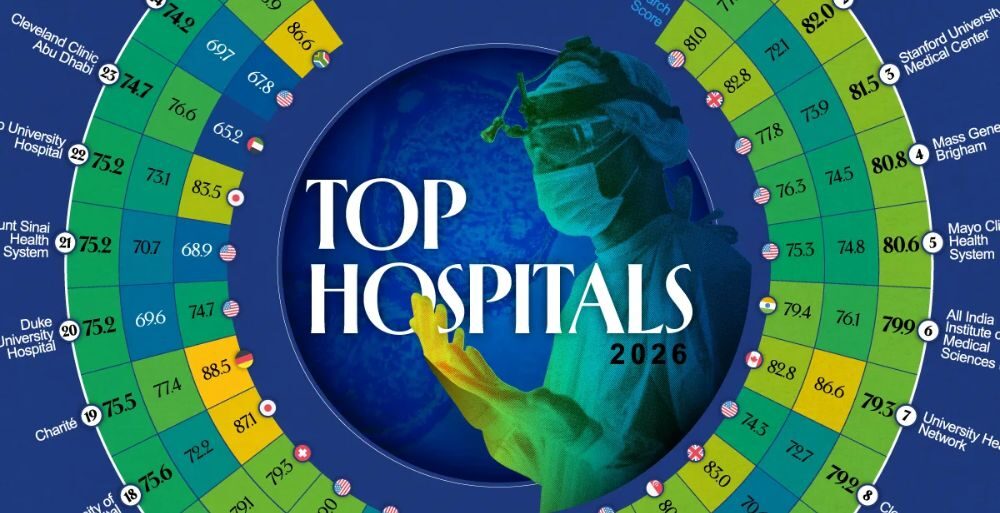

The 2026 data reveals specific leaders within specialized categories of the index. Canada’s University Health Network achieved the highest score in the Care category among the top 25 institutions, posting a mark of 86.6. This metric focuses on patient-centric outcomes, safety protocols, and the overall quality of clinical delivery. Meanwhile, the Research category was led by Germany’s Charité – Universitätsmedizin Berlin, which earned a top score of 88.5. The University of Tokyo Hospital followed as a close second in research excellence with a score of 87.1, illustrating the significant intellectual contributions of European and Asian institutions to the global medical community.

Geographically, North America continues to hold a dominant position in the rankings, accounting for 12 of the top 25 spots. The United States remains the primary driver of this trend, hosting 11 of the top-tier institutions, including Mass General Brigham, Mayo Clinic Health System, and Cleveland Clinic. This concentration of brand power is supported by the vast intangible value of the American healthcare economy, which is estimated to account for over $5.5 trillion in patents, research pipelines, and proprietary medical protocols. However, analysts note that maintaining this leadership requires constant innovation as international competitors begin to close the gap in reputation and funding.

European and Asian institutions have shown significant upward mobility in the 2026 index. The United Kingdom is represented twice in the top 10, with Cambridge University Hospitals rising nine positions to reach the number nine spot. Singapore General Hospital also regained its standing as a premier global hub, ranking 10th and leading the Asia-Pacific region. These shifts suggest that while U.S.-based academic medical centers remain the standard-bearers for brand strength, the global landscape is becoming more balanced as institutions in Singapore, Japan, and the United Kingdom enhance their international profiles.

The Middle East is also emerging as a significant force in the global healthcare rankings. Saudi Arabia’s King Faisal Specialist Hospital and Research Centre moved up to the 12th position, while the United Arab Emirates saw representation through Cleveland Clinic Abu Dhabi at number 23. These rankings reflect substantial regional investments in healthcare infrastructure and a deliberate focus on building medical brands that can compete for complex tertiary and quaternary care cases on a worldwide level.

South Asia’s prominence is highlighted by the All India Institute of Medical Sciences in Delhi, which ranks 6th globally, and the Tata Memorial Centre at 13th. These institutions serve as critical anchors for medical research and specialized care in the region, reflecting India’s growing influence in the global healthcare sector. The inclusion of South Africa’s Groote Schuur Hospital at number 25 further demonstrates the geographic diversity of the 2026 list, marking it as a key representative of the African continent’s high-tier medical capabilities.

Brand strength in the healthcare sector is increasingly tied to the ability of an institution to manage its intangible assets. According to Brand Finance, the total value of intellectual property and intangibles in the healthcare industry has reached approximately $10 trillion. For academic medical centers, this value is rooted in the “virtuous cycle” of research and clinical application. High-reputation brands find it easier to recruit the world’s leading clinicians and researchers, who in turn drive the innovations that sustain the institution’s brand strength. This cycle is essential for maintaining a competitive edge in an era where healthcare professionals are increasingly mobile and funding is tied to measurable impact.

Current trends in 2026 suggest that technology integration is becoming a primary factor in brand perception. Institutions that successfully implement artificial intelligence for diagnostic accuracy and administrative efficiency are seeing positive correlations in their reputation scores. As the healthcare industry moves toward a more digital-first approach, the ability of a hospital brand to signal both technological sophistication and human-centered care will be the defining characteristic of future leaders. The Brand Strength Index serves as a barometer for this shift, indicating which systems are best positioned to lead the next decade of medical advancement.

Ultimately, the 2026 rankings serve as a reminder that hospital leaders must treat reputation as a quantifiable and manageable asset. In a globalized market for medical services, a strong brand acts as a beacon for patients seeking the best possible outcomes and for professionals looking to work at the forefront of science. As institutions like Johns Hopkins and Oxford continue to set the pace, the rest of the world’s medical centers are clearly investing in the research and care quality necessary to challenge the established order in the years to come.