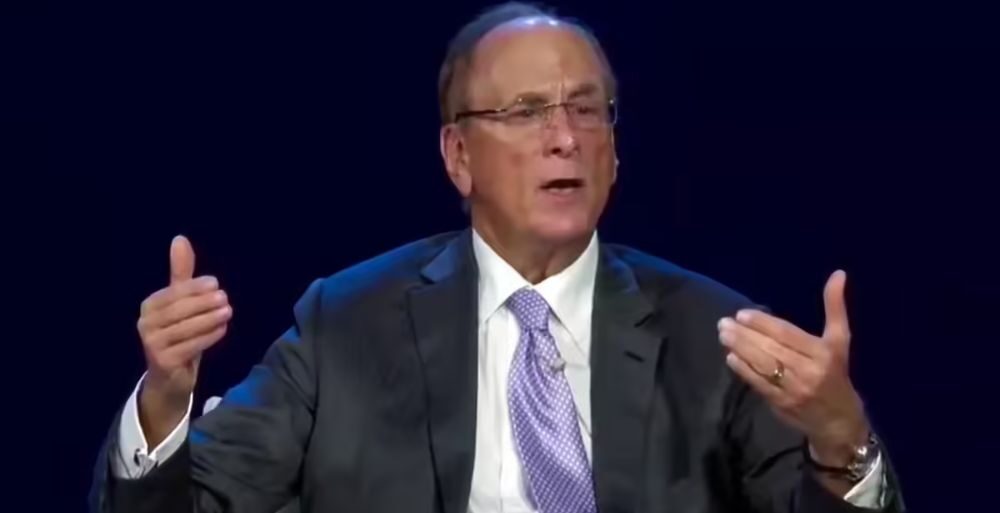

BlackRock Chief Executive Officer Larry Fink asserts that the next twenty-five years will represent a transformative era of sustained economic expansion for India.

The global investment landscape is shifting its primary focus toward South Asia as BlackRock CEO Larry Fink predicts a prolonged period of robust economic performance for India. Speaking at a high-level fireside chat titled “Investing For a New Era,” Fink outlined a visionary outlook for the nation, suggesting that the coming two decades will be defined by India’s rise on the global stage. According to Fink, the country is positioned to achieve annual growth rates between 8 percent and 10 percent over the next decade, marking a significant departure from the volatility seen in other major global economies.

This optimistic projection was shared during a conversation with billionaire industrialist Mukesh Ambani, where Fink emphasized that India represents the premier destination for long-term capital allocation. He argued that the “Era of India” is not a temporary trend or a cyclical upswing but rather a structural shift that will span twenty to twenty-five years. This perspective aligns with broader institutional sentiment that views India as a stable alternative to other emerging markets that have faced regulatory hurdles or demographic plateaus in recent years.

A central pillar of Fink’s thesis involves the maturation of India’s domestic financial ecosystem. While the importation of foreign capital remains a vital component of the growth story, Fink highlighted that the fundamental strength of any sovereign economy rests upon its internal capacity for wealth generation. He specifically noted that India has a decreasing reliance on external capital due to the burgeoning development of its domestic retirement savings and pension systems. By building a foundation on the back of domestic savings, India creates a resilient buffer against the flighty nature of international speculative capital.

Fink’s endorsement of the Indian market serves as a strategic call to action for both international institutional investors and the Indian populace. He suggested that for the nation to reach its full potential, there must be a concerted effort to deepen the participation of ordinary citizens in the capital markets. By encouraging long-term investment horizons rather than short-term trading, the BlackRock executive believes that a wider segment of the population can benefit from the appreciation of India’s leading corporations. This democratization of investment is seen as a necessary step to ensure that the projected 8 percent to 10 percent growth translates into broad-based prosperity.

The discussion also touched upon the role of government policy in facilitating this economic acceleration. Fink offered specific praise for the current administration’s efforts regarding digital infrastructure, particularly the implementation and scaling of the digitized rupee. He noted that the digitization of commerce has streamlined transactions and increased transparency, effectively modernizing the Indian marketplace at a pace that exceeds many Western counterparts. In a rare moment of direct comparison, Fink expressed concern that other developed nations, including the United States, are beginning to fall behind in the race to modernize financial technology and digital trade systems.

Beyond fiscal policy and domestic savings, the conversation pivoted to the technological drivers of future growth, specifically Artificial Intelligence. Addressing skepticism regarding the current valuation of technology firms, Fink dismissed the notion of an “AI bubble.” Instead, he characterized AI as one of the most disruptive forces in human history, essential for maintaining geopolitical and economic competitiveness. He warned that the failure to aggressively invest in AI infrastructure and integration poses a systemic risk, suggesting that leadership in this sector is a zero-sum game in the context of global competition with China.

The integration of AI into the Indian economy is expected to act as a force multiplier for the growth projections Fink described. By leveraging a massive, tech-literate workforce and a government committed to digital transformation, India is uniquely positioned to adopt AI at scale. Fink’s commentary suggests that the intersection of traditional industrial growth and high-tech innovation will be the engine that sustains the 10 percent growth targets over the next quarter-century. This dual-track development strategy distinguishes India from other emerging markets that rely solely on manufacturing or commodity exports.

Institutional interest in India has been bolstered by the country’s demographic dividend, featuring a young and expanding working-age population. As other major economies face the challenges of aging populations and shrinking labor forces, India’s demographic profile provides a natural tailwind for consumption and productivity. Fink’s remarks indicate that BlackRock, as the world’s largest asset manager, views these demographic trends not just as a statistical advantage but as a core component of the country’s investment appeal. The focus on “retirement savings” mentioned by Fink underscores the need to capture the productivity of this young workforce and channel it back into the nation’s infrastructure and equity markets.

The partnership between global financial giants like BlackRock and domestic leaders like Reliance Industries signifies a new phase of collaboration in the Indian market. By aligning international expertise in asset management with local operational scale, these entities aim to build the very capital market infrastructure Fink identified as essential. The move toward more sophisticated financial products and services is expected to provide the liquidity necessary to fund large-scale infrastructure projects and corporate expansions, further fueling the projected decade of high-velocity growth.

While the outlook remains overwhelmingly positive, the path toward the “Era of India” requires the continued evolution of regulatory frameworks and ease of doing business. Fink’s emphasis on the “long horizon” serves as a reminder to investors that while the destination is promising, the journey involves navigating the complexities of a massive and diverse democracy. The commitment to a twenty-five-year vision suggests that institutional players are looking past short-term geopolitical noise and focusing on the underlying structural strength of the Indian economy. This long-term conviction is expected to influence capital flows into the region for years to come.

In conclusion, the endorsements from the BlackRock leadership reflect a broader consensus that the global economic center of gravity is shifting. India’s combination of digital innovation, domestic capital formation, and aggressive growth targets has created a unique window of opportunity. As the nation embarks on this multi-decade era of expansion, the emphasis will remain on ensuring that the growth is inclusive, sustained by robust capital markets, and driven by the next generation of technological advancements. For global investors, the message from the top of the financial world is clear: India is no longer just a market to watch, but the primary theater for long-term growth.